Over a decade on from the inception of Bitcoin in 2009, cryptocurrencies are emerging from their infancy, becoming an increasingly used method for the buying and selling of products, from coffees to cars to yachts, as well as being able to fund recreational activities such as sports betting.

Indeed, while crypto-usership was once seemingly limited to coding enthusiasts and speculating students, it is now exploding as tech savvy Millennials are being joined by Generation Z to push the number of cryptocurrency users beyond an estimated 100 million globally.

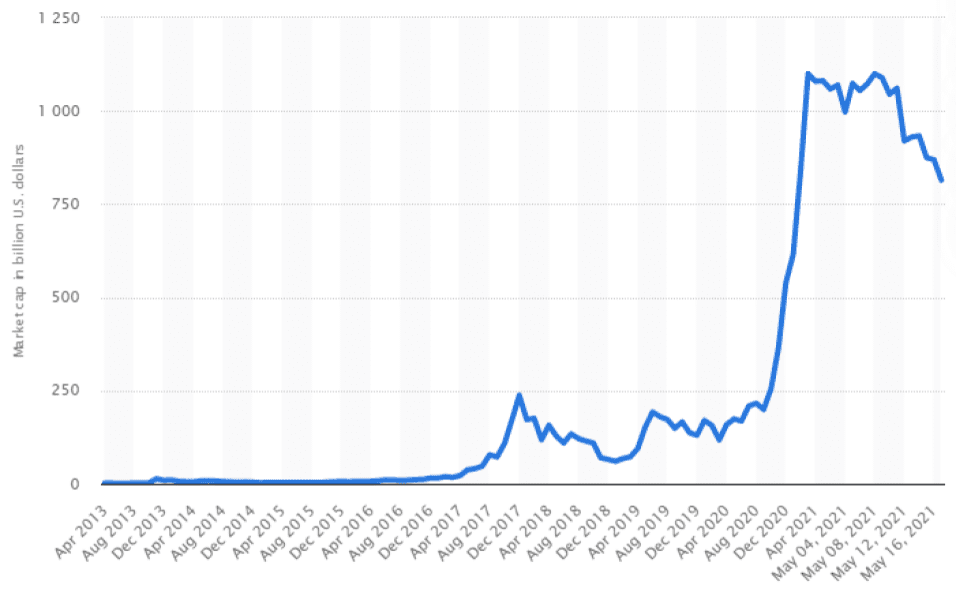

This growth in demand, and speculation of future demand, pushed the often-volatile price of Bitcoin to a high in excess of $60,000 in April 2021, with the total Bitcoin in circulation worth above $1000 billion in the same month, an increase of over 200% from early 2020.

Innovation in sports betting… and in sports manipulation

New start-ups have seized on this popularity, and in sports betting the demand from customers for funding accounts through cryptocurrency has led to the rise of a parallel industry, with over 120 operators, operating outside of the licensed markets of Europe or the US, offering a bitcoin payment solution and over 25 operators offering a crypto-only ‘end-to-end’ service. The growth of this crypto-sportsbook market has the potential to impact the scope of sport and betting related fraud.

Technological innovation through the last two decades has revolutionised an age-old industry, and as the scope of what to bet on, how to bet, who to bet with, and the way to make financial transactions has changed, the manipulation of sporting events has also evolved.

Advancements in data gathering and real-time data transmission have been the catalyst for improving the offering to customers in recent years, with a broader range of markets and events available to bet on. And while this enhanced offering has improved the customer experience, it has also created a new opportunity for those small number of people intent on manipulating sporting events for profit.

While an athlete, official, or group of either, may be responsible for the success of any sporting manipulation, the assumed method of modern-fixing places them in a networked organisation of individuals with various responsibilities, including fixers, bettors, money launderers, agents and club officials as well as a boss.

This method, which has to financially benefit so many parties, has been enabled by the ability for large quantities of money to be staked on known outcomes with multiple bookmakers in regulated and unregulated markets and the way in which new technologies have facilitated cheap, fast communication and money transfers.

Having a layered network has been a requirement, as to insulate the different parties from detection. Most obviously, it has been necessary for an organisation to ensure that the bettors and the player cannot be linked, and indeed for the player not to have to bet on their own match, something easy to detect, particularly for bookmakers in the regulated sports betting industry with effective KYC and risk management processes in place, as well as processes to report any concerning activity to the relevant regulator and sporting body.

The anonymity that the bettor has when betting at a crypto-sportsbook, where there are no identity requirements to open an account and no straight-forward link to the owner of the cryptocurrency wallet used to fund it, allows for a change in match-fixing methodology.

Added anonymity

Although large match-fixing networks may continue in a form similar to that outlined, it is likely a different method has developed and will continue to become increasingly prevalent alongside it, operating on a smaller scale, thanks to the new-found opportunity for the athlete, or official, to bet easily and directly on their own events with little to no risk of their identity being linked to the bets placed.

While the anonymity provided to the bettor can be regarded as similar to that of an agent system of betting, associated with the unregulated Asian sports betting market, the crypto-sportsbook market can act as a more accessible alternative to that market, offering not only anonymity but also the ease of direct, instant bet placement with an online operator rather than using an agent or online broker, often having to use a messaging service in order to place bets and provide personal details.

And, although sportsbooks in the unregulated Asian market generally accept higher stake wagers than elsewhere, as usage increases and recreational betting grows in the crypto-sportsbook market, the ability to place large wagers will also likely increase as crypto-sportsbooks increase the limits on stake sizes to accommodate genuine high-rolling bettors and provide a more attractive product than their competitors.

Indeed, while the crypto-sportsbook and unregulated Asian market are regarded as separate here, the adoption of cryptocurrencies as a payment solution by online brokers ahead of the regulated markets would increase the potential for betting-related fraud further due to the added layer of anonymity.

Can data be the answer?

The growth in cryptocurrency usage, and the corresponding demand for crypto-only-sportsbooks, therefore, presents a challenge to the regulated sports betting sector, with the incorporating of a crypto-payment solution perhaps regarded as necessary to retain and attract crypto-enthusiastic customers. Indeed, some regulators are in the process of building a framework for how operators can integrate cryptocurrency payments into their product with early indications that there will be the understandable, and seemingly unavoidable, need for the customer to register their identity and link it to their crypto-wallet, albeit perhaps through a third-party provider or crypto-token mechanism.

Although this is a responsible action, in order to know the customer for their own consumer protection as well as for anti-money laundering purposes, it highlights the conundrum facing the regulated industry. Will there be a demand to use cryptocurrencies in a sports betting market that has KYC requirements if the popularity of cryptocurrencies and the demand for them, and for their use in sports betting, is related to the system being relatively anonymous?

Indeed, if crypto-bettors remain outside of the regulated market the opportunity for a new, largely player-led, method of match-fixing poses plentiful questions for an infrastructure that has been developed to detect and tackle integrity issues in sport. And while these questions may be difficult to answer, solutions are likely to be found in the regulation of the supply of data to crypto-sportsbooks.

Data suppliers enable the cryptocurrency bookmakers to offer betting markets, akin to those of regulated operators, in an unregulated and opaque space, and perhaps limitations need to be placed on whom such data can be supplied to, in order that the methods in place for detecting match-fixing remain relevant.

Jack Byrne has over ten years of experience in the sports betting industry, joining the International Betting Integrity Association in early 2021. As IBIA’s Integrity Analyst, Byrne is responsible for analysing irregular betting activity reported to the association by their membership, made-up of sports betting operators in the regulated betting market, as well as identifying trends and assessing future risk to sport of betting related fraud.