There are three key components to chart success: distribution, penetration and game design. This article looks at distribution and specifically, indirect distribution, or how to expand your coverage via aggregators.

The more the merrier

“How do we get on operator Z’s site?” the boss or chairman asks? Uh oh, there’s that question again – slightly gentler than the more accusatory, “Why are we not on Z’s site?”, or “Why haven’t you done a deal with Z?”.

As there are zero incremental costs on gameplay, more distribution means a higher bottom line. The more (and bigger) sites your game appears on, the more turnover it generates, hence the obvious and predictable questions.

While you might entertain ambitions of hundreds of operator deals around the globe, this is a long haul. Operators have very little bandwidth for integrating new studio partners directly and getting to the top of an operator’s roadmap is a major hurdle for direct integrations.

You’re not only competing with other studios and aggregators (and operators will prioritise by size) but also payment processors, data feed suppliers, CRM tools, maintenance and upgrade projects and the raft of new compliance functionality that needs adding on a regular basis.

Melvin Ritsema, managing director of Royal Panda, says that operators can no longer cope with too many separate integrations. “Let’s be optimistic and say the integration of one game supplier is two weeks… [if you have] 50 suppliers for an operator, that’s 100 weeks of development, or two full years”, he told Casinobeats Malta Digital last year.

Data from Egamingmonitor.com reveals there are an average of 32 studios per operator, which implies at least a year’s worth of integration work, not to mention the ongoing maintenance and compliance implications of hosting so many partner feeds. In this context, the more traditional chain of studio/aggregator/operator may be making a comeback.

It’s no wonder that some studios, having integrated into a couple of operators, see the potential to act as aggregators for other studios that have been left out in the cold.

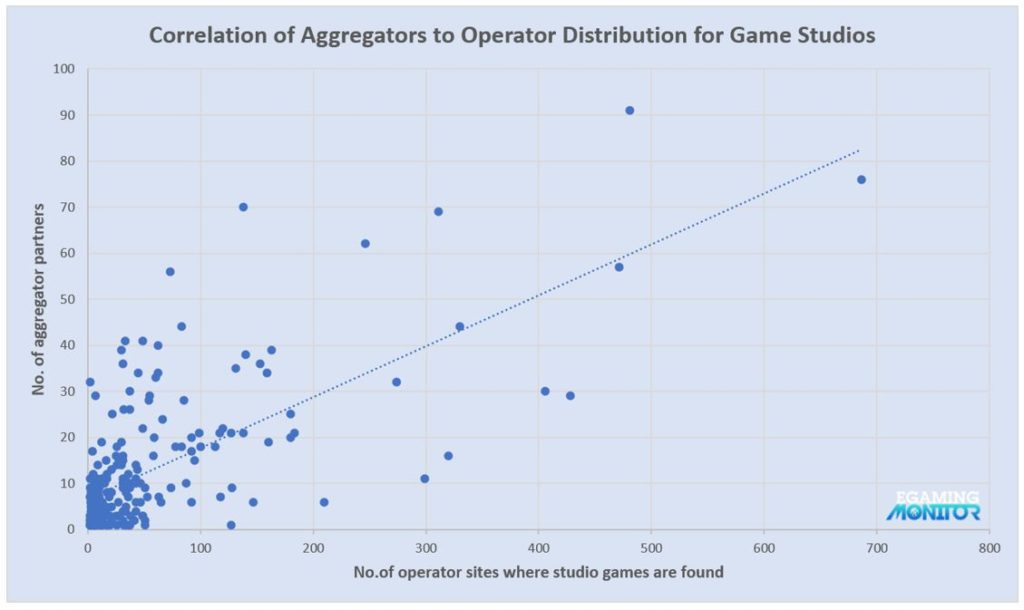

Most importantly, there is a close correlation between the number of aggregator deals and game distribution.

More aggregators = greater distribution

At Egamingmonitor, we have mapped out the complex relationships between 500 gaming studios to 350 aggregators and 1,000+ operators.

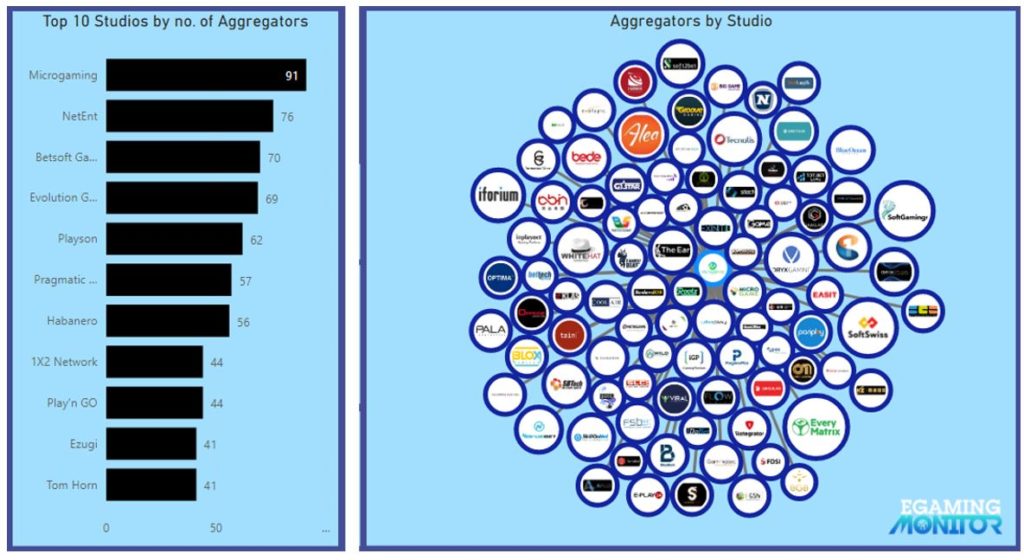

Here’s a top 10 chart of studios, ranked by the number of aggregator partners they have. The size of the aggregator partner ‘bubbles’ is a function of the total games they aggregate from all of their studio partners.

Microgaming tops the chart here, distributing its games to 91 platform providers or aggregators. Everymatrix, Oryx, White Hat, Alea, SoftSwiss and Iforium are some of the larger aggregators they distribute to, for example.

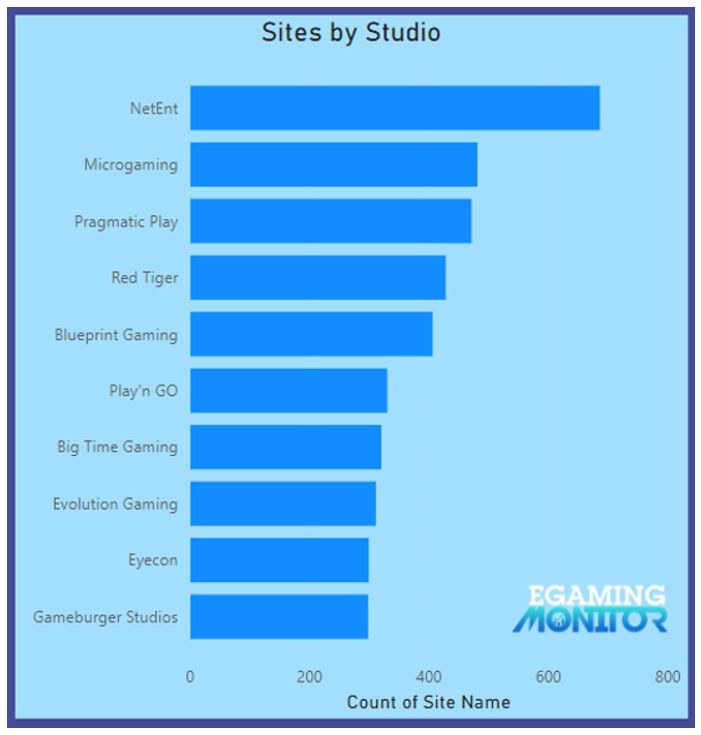

It’s no coincidence then that those studios with the most aggregator partners also feature strongly in overall game distribution – measured as the number of operator sites where their games appear. Five of the top 10 studios by number of aggregator partners are also in the top 10 by number of operators.

If we group studios under their gaming groups, the picture does change slightly, with the likes of Gauselmann, SG Digital and Playtech featuring higher in the charts. Note also that Microgaming’s 10 ‘independent’ studios are not grouped in this view either.

The scatter chart below shows first how our industry is characterised by many small studios with a handful of operator sites and aggregator partners. For the medium/larger companies there is a good correlation between the number of aggregators and the number of operator sites where games are distributed.

So if the objective is to achieve the broadest possible distribution within the shortest period of time, then the indirect route can deliver. In return for broad distribution and shared functionality, a studio will realise a lower percentage but of a far higher turnover.

Aggregator choices

Studios still need to get onto a product roadmap, that of the platform provider, but once integrated, the reach can be impressive. There is, of course, a difference between being listed as a partner and being fully integrated into an aggregator’s engine.

A full integration into the RGS takes longer as game components are often rebuilt on the aggregator’s platform, though this also means that studios benefit from shared functionality such as leader boards, tournaments and networked jackpots. This, in turn, means better uptake by operator clients of the distributor.

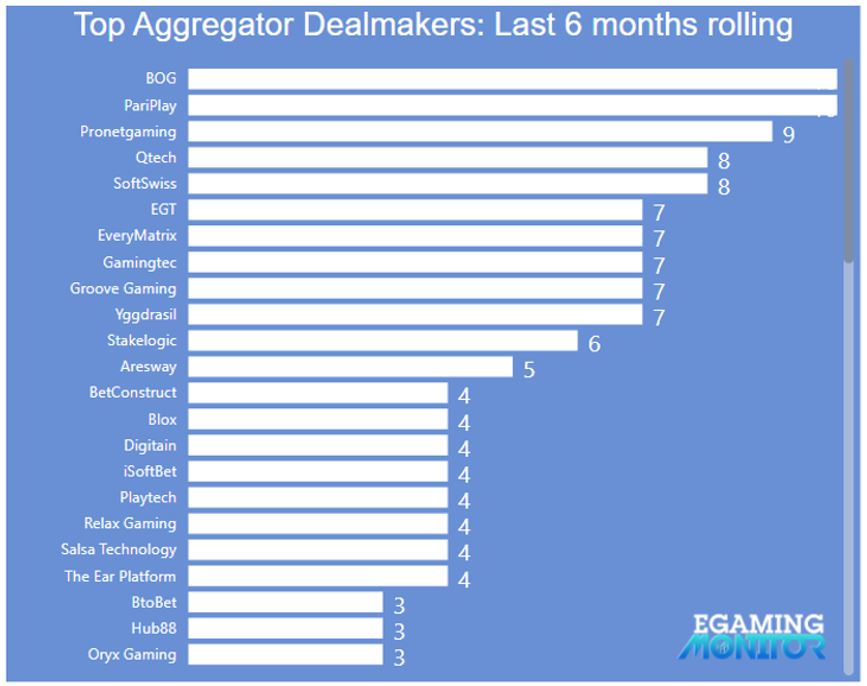

A closer look at the data can identify potential aggregator partners, with a preference perhaps for those that seem to achieve new studio integrations faster than average. The snapshot below from iGB’s interactive Casino Dashboard highlights the busiest aggregator dealmakers in recent months, for example.

Over the last six months, a total of 197 deals were announced between 70 aggregators and 120 studios, with BOG and PariPlay topping the charts with 10 deals each in the period.

Conversely, you could focus instead on those that partner with just a small number of studios, where your products will have more attention and take up more shelf space. Alternatively, you may want to filter the data by country, highlighting a geographic angle to your aggregator opportunities. If you prefer quality to quantity, you might focus on those serving Tier 1 rather than Tier 2 operators, and so forth.

If you’re looking for the broadest possible distribution for the least cost in the shortest amount of time, indirect distribution is where it’s at. With 350 firms characterised as either aggregators or aggregator/studio hybrids, there are plenty of opportunities for indirect market access.

Kevin Dale is the co-founder of eGaming Monitor. He was previously CEO of Gameaccount (now GAN plc) and CMO at Eurobet, Sportingbet and Betfair. Egamingmonitor.com is an advisory firm to the gambling industry, with proprietary data covering 30,000 games from 1,000 suppliers across 1,000 operator sites.

Image: Photo by Mateo Vrbnjak on Unsplash